Complete Guide

Insurance Savings Plans 101

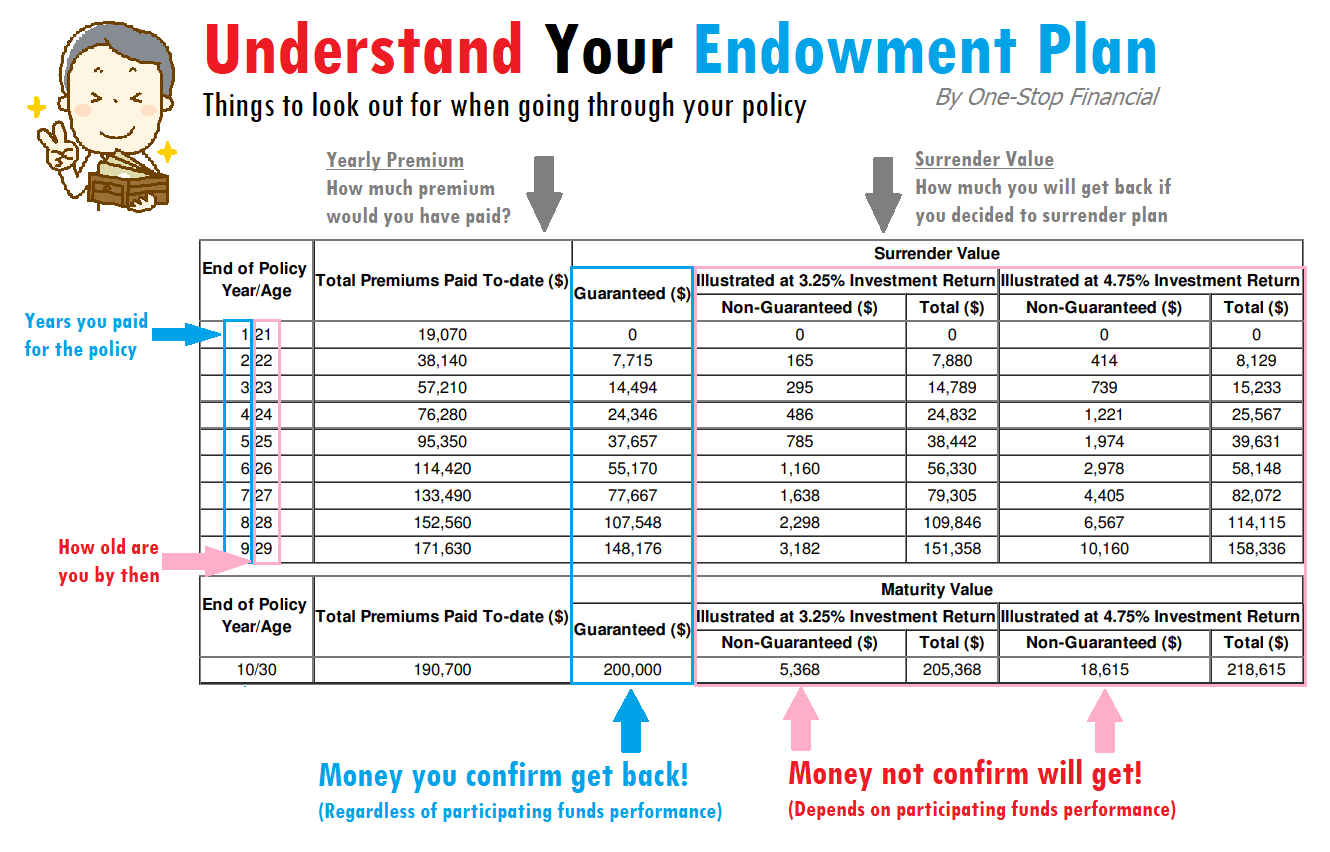

Everything you need to know about endowment plans in one visual guide.

💡 Key Takeaway: Insurance savings plans (endowments) help you save for specific goals while providing life protection. They offer both guaranteed and non-guaranteed returns.