Enhance Your Coverage

CareShield Life Supplements

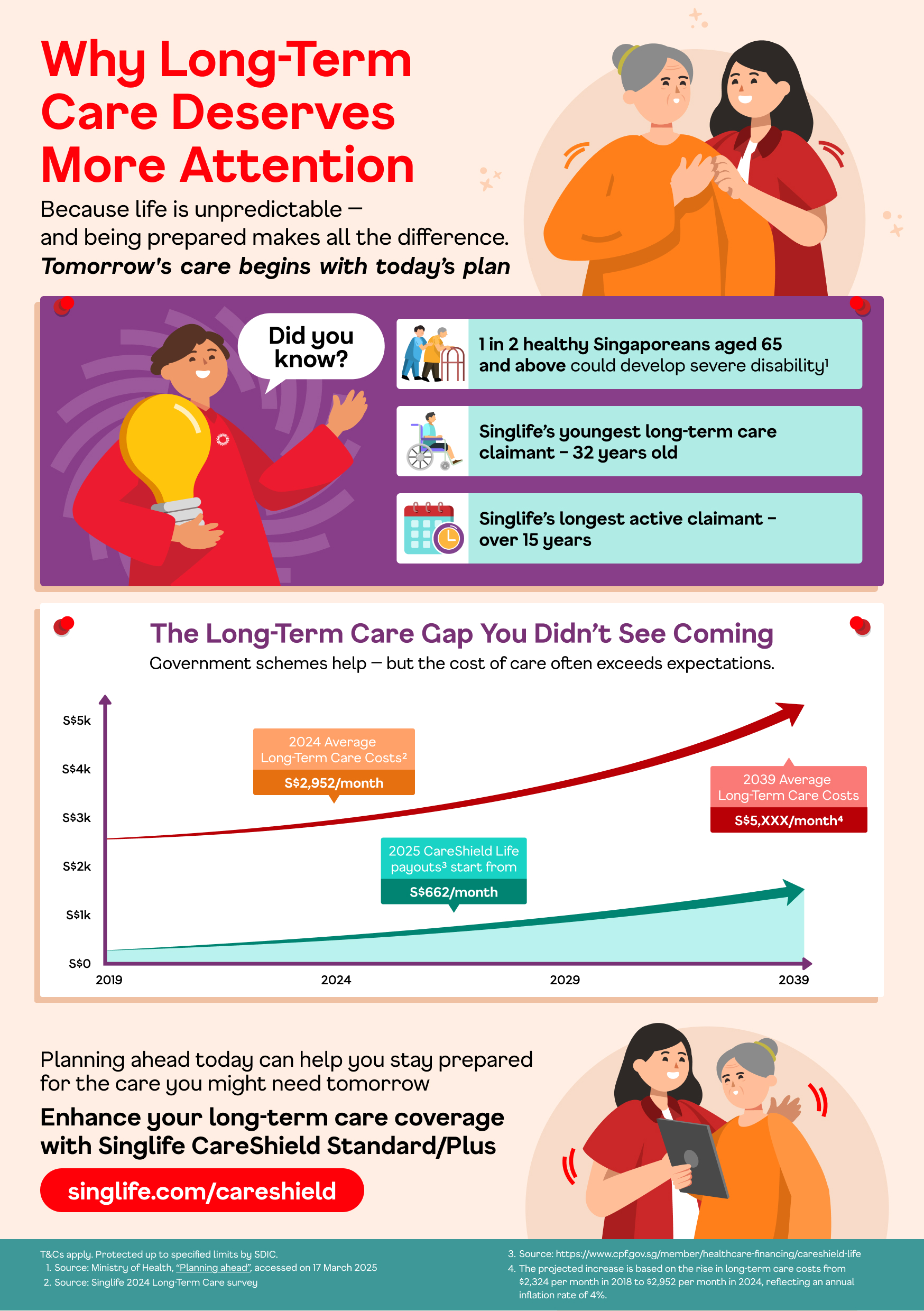

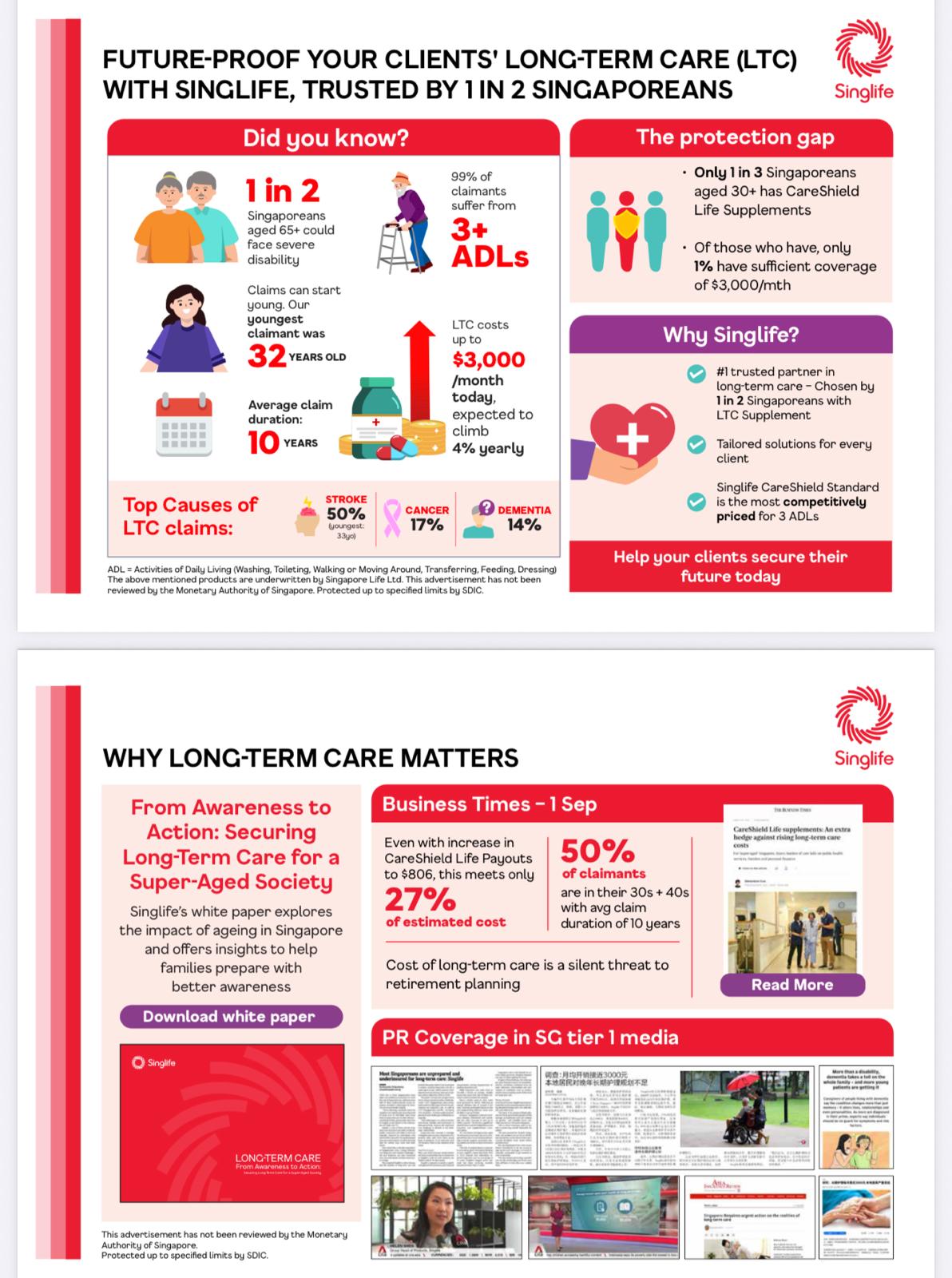

While CareShield Life provides basic coverage, the $600/month payout may not be sufficient for quality long-term care. CareShield Life Supplements (CSLS) allow you to top up your coverage with additional monthly payouts. Only 3 insurers are approved to offer CSLS:

| COMPARISON OF CARESHIELD LIFE SUPPLEMENTS | |||

|---|---|---|---|

| SINGLIFE Recommended |

GREAT EASTERN LIFE | INCOME | |

| Singlife CareShield Standard/ Singlife CareShield Plus |

Great CareShield Supreme | Care Secure | |

| Monthly Benefit | $200-$5,000, in increments of $100 (on top of CSHL payouts) Option for level or escalating at 2%/3% p.a. |

$300-$5,000, in increments of $100 (on top of CSHL payouts) |

$1,200-$5,000, in increments of $100 (including CSHL payouts in event of ≥3 ADLs) |

| Maximum Benefit Period | Lifetime | Lifetime | Lifetime |

| Initial Lump Sum Benefit | 3x first monthly benefit (≥3 ADLs) [≥2 ADLs for Plus] |

3x monthly benefit (≥1 ADL) |

3x monthly (≥2 ADLs) 6x monthly (≥3 ADLs) |

| Death Benefit During Claims | 3x last monthly benefit | ✗ | 3x monthly benefit |

| Dependant Benefit | 20% of monthly for up to 36 months (child ≤22 at claim) |

30% of monthly for up to 48 months (child <22 at claim) |

25% of monthly for up to 36 months (child <21) |

| Caregiver Relief Benefit | 60% of monthly for up to 12 months | 60% of monthly for up to 12 months | ✗ |

| Other Benefits | Rehabilitation benefit (Standard only) Guaranteed Issuance Option at key life events |

✗ | ✗ |

| Paid-up Benefits | Yes | Yes | Yes |

| Premium Waiver | ≥1 ADL | ≥1 ADL | ≥2 ADLs |

| Claims Eligibility (for monthly benefit) |

≥3 ADLs [≥2 ADLs for Plus] |

≥1 ADL (50% at 1 ADL, 100% at 2+) |

≥2 ADLs |

| Waiting Period | None ✓ | 90 days | 90 days |

| Deferment Period | 90 days | 90 days | 90 days |

| Est. Premium (Age 30, $600 benefit, Male) |

$266-$394/year (depending on plan) |

$287-$425/year (depending on plan) |

~$400-$500/year (for $1,200 benefit) |

| Medisave Payment | Max $600/year via Medisave Rest payable in cash |

Max $600/year via Medisave Rest payable in cash |

Max $600/year via Medisave Rest payable in cash |

| Premium Period | Up to age 97; or Up to age 67 (or 20 years) |

Up to age 67 or 95; or Up to 95 (or 20 years) |

Up to age 67; or Up to age 84 |

| Entry Age | 30 - 64 | 30 - 64 | 30 - 64 |

Source: MOH CareShield Life Supplements Comparison (Oct 2023)

💡 Our Recommendation

Singlife CareShield offers great value with no waiting period, flexible premium options, and unique benefits like rehabilitation and guaranteed issuance options at key life events.

Get Personalized Advice